Facing foreclosure in Anchorage, Alaska, can be a confusing experience, but understanding your options is crucial. This comprehensive guide aims to help you with practical insights and strategies to navigate foreclosure and explore selling opportunities. We will go over the essential steps, address common concerns, and simplify complex procedures to help you make informed decisions.

Key Highlights

- Alaska offers judicial and nonjudicial foreclosure methods, each affecting timelines and costs differently for homeowners.

- Understanding foreclosure laws in Anchorage is crucial for homeowners, as it significantly impacts their decision-making and outcomes.

- Effective marketing and accurate property valuation are crucial for a successful home sale amid foreclosure in Anchorage.

- Resources like Alaska Housing Finance Corporation provide counseling and options for managing foreclosure challenges.

- Engaging organizations like Alaska Legal Services Corporation can provide essential legal guidance during foreclosure proceedings.

Understanding the Foreclosure Process in Alaska

Understanding the foreclosure process in Alaska is crucial for homeowners facing financial difficulties. Navigating through foreclosure can be daunting. Thankfully, Alaska law offers specific processes that protect both lenders and borrowers. We’ll explore how the foreclosure process works in Alaska, focusing on its unique characteristics. We’ll also delve into the different foreclosure methods employed statewide, with an emphasis on the distinction between judicial and nonjudicial foreclosures. This knowledge will help homeowners make informed decisions, especially when considering selling their homes in foreclosure.

What is Foreclosure and How Does It Work in Alaska?

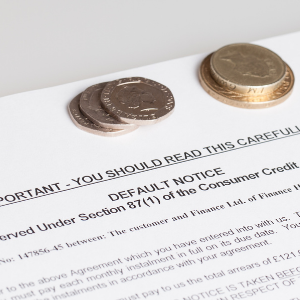

Foreclosure in Alaska involves a lender seeking to reclaim a property due to the borrower’s inability to meet mortgage obligations. This process begins with the lender notifying the homeowner of the delinquency. Alaska law requires lenders to provide a notice of default, which highlights the missed payments and offers a timeframe for remedy. This stage marks the official beginning of the foreclosure process in Alaska, allowing homeowners to rectify their situation before further action is taken.

Under Alaska’s foreclosure process, homeowners have options. They can pay off the missed amounts to halt foreclosure or negotiate with their lender for possible alternatives. Facing foreclosure doesn’t necessarily mean losing your home right away. Alaska’s legal framework ensures that homeowners can explore options such as loan modification or short sale.

Interestingly, foreclosure in Alaska can be judicial or nonjudicial. Judicial foreclosure, involved with a court ruling, tends to be more prolonged and more costly. Nonjudicial foreclosure, on the other hand, operates outside the court system. It’s generally faster, requiring adherence to specific procedural steps outlined by Alaska law. Despite its speed, transparency is still necessary, as public notice is required before any auction. This ensures fairness and clarifies buyer expectations and obligations regarding the foreclosure process.

Such detailed protocols in Alaska ensure that both lenders and borrowers are treated fairly, providing homeowners a chance to understand their rights and responsibilities. Understanding these elements can arm you with the necessary knowledge to navigate the foreclosure effectively.

Types of Foreclosure Methods Used in Alaska

Homeowners facing foreclosure in Alaska should understand that the state uses two primary foreclosure methods — judicial and nonjudicial foreclosure. Each follows a different process and has unique legal and financial implications. Knowing which applies to your situation is crucial to protecting your rights and determining your best course of action.

A judicial foreclosure is a court-supervised process in which the lender files a lawsuit against the borrower for failing to make payments. The court oversees every step, ensuring the process follows legal standards and that homeowners have the opportunity to respond.

Judicial foreclosures can provide borrowers with additional time and oversight, making it easier to pursue legal defenses or negotiate with lenders. However, this method tends to take longer and can be more expensive for both parties due to court fees and extended timelines.

The nonjudicial foreclosure process is more common in Alaska. It allows lenders to reclaim the property without court involvement, provided the mortgage includes a “power of sale” clause. This method is typically faster and less costly, but requires homeowners to act quickly.

The process begins when the lender issues a Notice of Default (NOD) — a formal notice that the borrower is behind on payments. Alaska law ensures that homeowners are given a fair opportunity to reinstate the loan, negotiate repayment terms, or sell their home before foreclosure proceeds further.

If the borrower fails to resolve the default, the lender then issues a Notice of Sale. This notice must follow strict legal requirements, including public posting, to ensure transparency. The property is then sold at auction, often leading to quicker resolution but fewer opportunities for the homeowner to retain the property.

Alaska’s foreclosure laws prioritize fairness by requiring public notices and detailed procedural steps. These measures are designed to protect both homeowners and potential buyers, ensuring accountability throughout the process. However, homeowners must move quickly — especially in nonjudicial foreclosures, where timelines are much shorter.

Understanding the differences between judicial and nonjudicial foreclosures in Alaska can help you take control of your situation. Working with an experienced foreclosure attorney or local housing counselor in Anchorage can ensure you comply with state regulations, explore your options, and possibly sell your home before foreclosure to minimize losses.

Having this knowledge empowers you to make confident, proactive choices that protect your financial future — even in the face of foreclosure.

Can You Sell a Home in Foreclosure?

If you’re facing foreclosure in Anchorage, Alaska, you might wonder if it’s possible to sell your home during this process. Selling a foreclosure home is indeed feasible, but it requires careful navigation and understanding of the legal and financial landscape. This section will guide you through the steps needed to sell your foreclosed home before auction. Additionally, it will highlight the legal considerations homeowners must take into account in Alaska, ensuring you make informed decisions during this stressful time.

Steps to Selling Your Foreclosed Home Before Auction

Knowing how to sell your foreclosed home before it goes to auction can be lifesaving in a challenging financial situation. First, it is vital to calculate the home’s current market value. Understanding how much you might be able to sell your home will help you decide the best approach for your situation. You may consider engaging a real estate agent to do a comparable market analysis of your area in Anchorage to help you understand how the housing market is behaving for similar houses. This becomes extremely helpful in pricing the home to sell fast, which is vital if you have time-sensitive issues, given the nature of a looming foreclosure.

Another step that is vital in a situation like this is to communicate with your lender. Let the lender know you wish to sell the house, and explore the possible approaches to a short sale option. A short sale is a transaction where the home is sold for an amount that is less than the remaining mortgage balance with a lender’s consent. This may be able to stop the foreclosure process; however, it may still negatively impact your credit score. Being able to negotiate terms in a situation like this is vital. Typically, lenders would like to avoid incurring foreclosure costs, so record-low offers are usually accepted as a means to this end.

It is equally important to ensure that the home is marketed effectively. Focus on the pros of the property, and make sure it is in a suitable condition for prospective buyers. Hiring a professional home stager, or even a certified financial planner, may help in the appreciation of the property. Make sure to use a combination of digital channels and local ads to maximize visibility. Time is of the essence; thus, a multi-pronged, quick approach to marketing can generate curiosity among prospective buyers and help with a quick sale. In the case of auctioning a home that has been foreclosed, it is essential that you keep record of the sale and correspondence with other parties, as it will help you achieve beneficial results.

Legal Considerations for Homeowners in Alaska

Understanding the legal framework for selling foreclosed homes in the state of Alaska requires a close examination of the state’s rules and regulations. Knowing whether the Alaska court system uses judicial or non-judicial foreclosure relating to your case is essential. This not only impacts the timeframe you have to work with, but also the specific legal measures you need to take. In every situation, though, it is essential to understand your rights and responsibilities as a homeowner.

One of the most critical issues is the borrower’s notice requirement. No conduct of foreclosed Alaska’s homeowners starts without a formal Notice of Default. This creates an opportunity for a homeowner to contest the foreclosure and, therefore, negotiate for better terms with their lenders. Ignoring the steps of the process for a long time and using inaction can potentially result in escalation. This foreclosure ends in an auction and is referred to as a foreclosure sale.

Having a foreclosure attorney on retainer can prove to be beneficial. A foreclosure lawyer in Alaska can provide options and formulate strategies tailored to your specific situation within the particular legal and financial contexts. This can be achieved by negotiating with the lender on your behalf or by seeking legal representation in court when the situation warrants it. Not only can legal representation ensure compliance with the procedural steps, but if more time is needed to sell the property, it can also intervene and seek to extend the timeline.

Another consideration is the effect that a foreclosure can have on your credit rating. If a sale is completed before the foreclosure process begins, the credit consequences may be minimized. Alaska’s legal frameworks, understanding, and ever responsiveness to changes in communication, and the securing of legal advice can be the only means to achieve all these. There are strategies in selling under foreclosure to mitigate exposure to unwanted risks and increase the chances of a successful outcome.

Navigating the Anchorage Real Estate Market

Exploring the real estate market in Anchorage, Alaska, requires an understanding of foreclosure dynamics unique to the region. With the right strategies, homeowners facing foreclosure can develop effective marketing plans and accurately assess property values. We will delve into insightful tips for marketing a home under foreclosure, as well as the importance of understanding property values and their sale potential. Harnessing such knowledge can empower sellers to maximize their property’s market appeal and execute informed sales that benefit their financial situations.

Tips for Marketing Your Home Amid Foreclosure in Anchorage, AK

Marketing your home during foreclosure in Anchorage requires a strategic and proactive approach. With time-sensitive financial pressures, homeowners must focus on attracting serious buyers quickly and maximizing their property’s visibility. Understanding how to market your Anchorage home effectively can help you sell faster and minimize financial losses.

Begin by conducting a comparative market analysis (CMA) to evaluate similar home sales in Anchorage and nearby areas like Wasilla, Palmer, and Eagle River. Setting a fair and competitive price ensures your home stands out in Alaska’s dynamic real estate market. Since foreclosure situations often come with tight deadlines, pricing your property strategically can help generate faster offers.

Highlight the best aspects of living in Anchorage to draw in potential buyers. Emphasize the area’s economic opportunities, outdoor attractions, and community amenities. Many buyers are attracted to Anchorage for its unique mix of urban convenience and access to Alaska’s natural beauty — points that can make your listing more compelling.

Visibility is key when selling under pressure. List your home on popular real estate websites, utilize social media marketing, and connect with local real estate networks to broaden your reach. Enhancing your online listing with professional photography, virtual tours, and detailed descriptions can help your property attract more views — and ultimately, faster offers.

If your timeline is tight, consider reaching out to cash home buyers in Anchorage who specialize in helping homeowners sell their homes fast before foreclosure. These buyers can provide a straightforward, no-obligation offer and close quickly, giving you peace of mind and financial relief.

Even minor upgrades can make a significant impact. Focus on minor repairs, fresh paint, and professional staging to enhance curb appeal. A well-presented home not only draws more interest but also builds confidence among potential buyers, helping you achieve better offers within a shorter timeframe.

Stay in close contact with your lender throughout the process. Discuss options such as short sales or repayment plans that may help you avoid full foreclosure. Consulting with a financial advisor or real estate professional experienced in Anchorage foreclosure sales can also help guide you in optimizing your outcomes.

By combining smart pricing, strong marketing, and open communication, homeowners in Anchorage, Alaska, can significantly improve their chances of selling quickly and recovering financially. With the right strategy — and by partnering with local experts or cash buyers — you can navigate foreclosure challenges confidently and move forward on a more stable footing.

But if time is tight or the stress is too high, reach out to Anchorage Home Buyers. They make the process simple — no repairs, no waiting, no hidden fees. It’s the fastest way to sell your Anchorage house for cash before the foreclosure timeline runs out.

Understanding Property Values and Sale Potential in Anchorage, Alaska

The real estate foreclosure procedure has unique challenges, particularly in determining projected anchor property values and sales. Local sales activity has unique economic sources, changes in season, and differential populations. Knowing competitive home values assists in pricing the property correctly. Selling property faster is obviously preferable. While schedules are tight, a foreclosure is the worst-case scenario.

There will always be a need for a comparative market analysis in the home pricing process. A real estate appraiser will compare the subject property with similar sales in the case of Anchorage, and the nearby suburban areas of Eagle River, Wasilla, and Palmer, to determine the market for the sales and the surrounding area. Attaining an effective CMA will assist the property holder in making a decision quickly.

In Anchorage, the location of homes matters. Homes located in proximity to and the versions of schools, parks, and beautiful geo-scenery, with modern technology, and energy-efficient homes, will be offered at immensely higher values. Understanding the systematic appeal of this context affects the sales outcomes, optimizing the sales process.

Stay updated on the potential infrastructure developments, new businesses opening, and community improvements in Anchorage, as these variables might affect future property values and enable you to sell at the appropriate time. If you sell your home at the peak of the housing market, you are much more likely to profit even with prospective foreclosure.

Like the rest of the state of Alaska, Anchorage practices both judicial and non-judicial foreclosures. These variables, in turn, affect your selling timeline as well as selling resources, and thus are of utmost importance. A legal and real estate professional can help guide you through your options and their legal implications. For example, you can prepare for an auction, short sale, or even accept direct cash offers.

When real estate data, legal knowledge, and market timing are intelligently integrated, Anchorage homeowners are in a position to make decisions that best decrease their losses. By consulting a real estate agent or cash buyers for homes in Anchorage, you will be able to untangle the next set of actions from the web of real estate and take a proactive approach before the situation becomes a stressful burden. Different kinds of sales — from foreclosure to estate sales — raise questions about authority to sell. See what it means when an executor can sell a house in Anchorage, AK.

Helpful Resources and Support During Foreclosure

When facing foreclosure in Anchorage, having access to robust resources and support can make a significant difference. Understanding where to seek assistance and how to leverage available organizations can help homeowners navigate the complexities of foreclosure. We’ll explore vital resources and organizations that offer support in Alaska, empowering you to retain your home or make informed decisions through the foreclosure process.

Where to Find Assistance with Foreclosure in Alaska

In Anchorage and Alaska, like many other regions, foreclosure can be a pretty scary process, but you can seek assistance because you are not alone. They offer these powerful, tailored programs that attempt to resolve such issues at lower price points.

The Alaska Housing Finance Corporation understands that foreclosure for many can bring hardship, and with the proper guidance, we can find a positive solution. AHFC’s foreclosure counseling with modification, refinancing, repayment plans, and more will aid in understanding and realizing the many options available. They help at a more local level and walk you step by step through the foreclosure process, while also developing a more realistic financial avenue.

Another nonprofit, NeighborWorks Alaska, focuses on the same goals but does so with more education on budget and debt management. They want to ensure that the people of Alaska develop a contingency plan for future obstacles so that they don’t have to suffer through the hardship while paying for the long-term solution.

The U.S. Department of Housing and Urban Development (HUD) has a link with certified local housing counselors who have specialized knowledge of local foreclosure laws and local market conditions. These professionals can assist you in negotiating with lenders, applying for various assistance programs, and other alternatives, such as short sales, selling your home in Anchorage before foreclosure, and preserving your credit.

Local and federal organizations can assist homeowners based in Anchorage, Wasilla, Palmer, and Eagle River in seeking help and relief. They can also help in analyzing various programs for the modification of loans. Obtaining legal assistance for multiple issues and options for selling a home also has immense value.

The process of foreclosure can be pretty daunting. With the right help and knowledge, there is a solution to everything, without losing your home and gaining financial stability for the future.

Alongside these resources, Anchorage Home Buyers offers another path: the ability to sell your home fast for cash in Eagle River and nearby areas and avoid the stress of drawn-out foreclosure proceedings. They handle everything from valuation to closing — helping Anchorage-area homeowners regain control quickly and easily.

Organizations That Can Help You Retain Your Home

Facing foreclosure doesn’t always mean you will lose your home—especially if you seek assistance early. In Alaska, several reputable organizations offer free or low-cost services for individuals who are having difficulty making their mortgage payments. These resources can help you understand your rights, identify steps to avert foreclosure, and even devise a strategy to sell your Anchorage home and prevent foreclosure to mitigate financial loss.

Alaska Legal Services Corporation provides vital legal advice and representation for individuals dealing with foreclosure. Your attorney will help you with your legal entitlements as a property owner in Alaska, which includes the foreclosure process and the laws that accompany it, which are both judicial and non-judicial. ALSC is mandated to engage in negotiations with lenders on your behalf to postpone or prevent foreclosure on the home, which is a part of financial loss mitigation.

AHFC provides foreclosure counseling and financial assistance to individuals who are already behind in making their mortgage payments. They can help you with a loan modification, a refinance, or a forbearance plan that you can afford. AHFC works with lenders to develop sustainable, low-cost plans that avert foreclosure and promote financial stability.

In Alaska, homeowners can access various federal programs. For instance, the Making Home Affordable (MHA) program provides mortgage relief options that can include lower payments, loan restructures, and even refinancing. Various federal and state regulations govern consumer finance, and the Consumer Finance Protection Bureau (CFPB) provides consumers within the mortgage industry a complaint mechanism for unfair treatment.

Within your local area, HUD-approved counseling agencies can deliver state-funded face-to-face counseling sessions to help mortgage holders understand their mortgage rights and their options when faced with possible foreclosure. These counselors can help develop a payment plan, loan restructure, or even help you sell your home quickly in Anchorage, thus avoiding foreclosure entirely.

The earlier you seek their assistance, the better. They help you regain your financial and emotional balance by providing better information regarding your choices. Even in the event of foreclosure, their assistance can make the difference between total loss and partial recovery, lessen the adverse impact on your credit, or shorten the time needed to sell the property.

The philosophy surrounding the sale of a foreclosed house in Anchorage, Alaska, might be daunting or intimidating, but the proper assistance can demystify the process. Time is of the essence. By aligning yourself with experts in foreclosure sales and cash home buying, the legal worries surrounding foreclosures can be soothed. The correct road map has the potential to allow new possibilities. Selling the home at a loss, restructuring the loan, or quickly selling a house in Anchorage for cash are all possible if the right tools and assistance are at your disposal.

Anchorage Home Buyers is dedicated to helping homeowners in Anchorage and nearby areas like Wasilla, Palmer, and Eagle River sell their houses fast for cash—offering fair offers, quick closings, and stress-free solutions for any situation, whether facing foreclosure, relocation, or financial hardship. Contact us at (907) 331-4472 today to get your offer!

Frequently Asked Questions

What are the different foreclosure methods in Alaska?

Alaska utilizes both judicial and nonjudicial foreclosure methods. Judicial foreclosure involves court proceedings, providing more oversight and legal scrutiny, while nonjudicial foreclosure bypasses the court system, making it faster and less expensive. It’s crucial to understand the distinctions as they affect timelines, costs, and rights for both borrowers and lenders.

Can you sell your home in Anchorage during foreclosure?

Yes, selling your home during foreclosure in Anchorage, Alaska, is possible. This requires understanding the legal and financial landscape, assessing the property’s market value, and effectively marketing it to attract potential buyers quickly. Options like a short sale, with lender approval, might also prevent foreclosure completion.

What resources are available in Alaska for homeowners facing foreclosure?

In Alaska, several resources are available to support homeowners facing foreclosure. The Alaska Housing Finance Corporation offers counseling and financial guidance. Non-profit organizations like NeighborWorks Alaska provide education and foreclosure prevention programs. Legal aid from the Alaska Legal Services Corporation can also help you understand your rights and explore options to retain your home, potentially.

What should homeowners in Anchorage do to market their foreclosed property effectively?

To market a foreclosed property effectively, conduct a market analysis to set a realistic price. Utilize online platforms to list the property, employ professional staging, and highlight appealing features. Communication with lenders about a potential short sale can also have a favorable impact on the outcome. Quick and strategic marketing is essential under time constraints.

How do judicial and nonjudicial foreclosures differ in terms of timelines and costs?

Judicial foreclosures follow a court-supervised process, which often takes longer and incurs higher costs due to court proceedings. Nonjudicial foreclosures bypass courts, speeding up the process and reducing expenses. However, they offer fewer opportunities for borrowers to contest the foreclosure and require strict adherence to procedural steps, such as issuing a public notice.

Helpful Anchorage Blog Articles

- How To Opt Out Of An HOA In Anchorage, AK

- Can Medical Debt Threaten Your Home Ownership In Anchorage, AK?

- Home Equity Requirements For Selling Your House In Anchorage, AK

- Selling Your Anchorage Home After Three Years

- Selling Your House To A Developer In Anchorage

- Home Equity Requirements For Selling Your House In Anchorage, AK

- Can You Sell A House With Asbestos In Anchorage, AK

- What Taxes Do I Have To Pay When I Sell My House In Anchorage, AK

- Selling a Home That Needs Repairs in Anchorage, AK

- Understanding Tenant Damage And Property Rights In Anchorage, AK

- Sell A Home With A Reverse Mortgage In Anchorage, AK

- Average Cost to Sell a House in Anchorage, AK

- What To Do If You Inherit a Distressed Home in Anchorage, AK

- Can You Sell a House in Foreclosure in Anchorage, Alaska?